Read WWE's Entire Q1 2023 Results Release, Including Details On UFC-Endeavor Deal

Ahead of its 2023 Q1 earnings call, WWE released highlights of the results of the first quarter of the year. See that release in its entirety below.

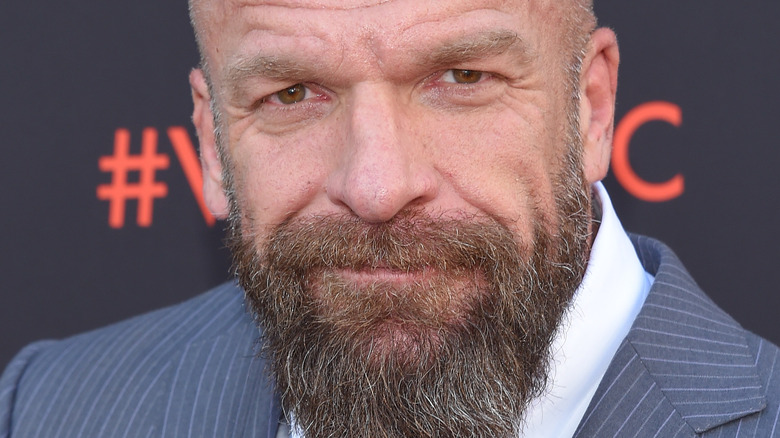

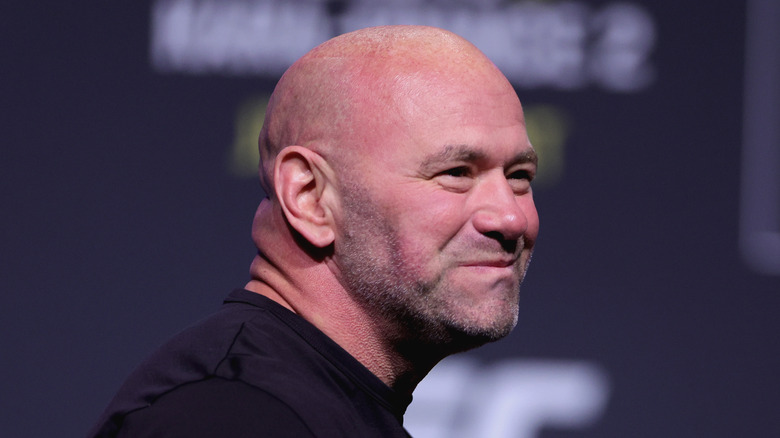

"We are off to a strong start in 2023. Operationally, we continue to effectively execute our strategy, including staging the most successful WrestleMania of all time in early April. WrestleMania, as well as our other successful premium live events such as Royal Rumble and Elimination Chamber, and strong viewership for our weekly flagship programs, Raw and SmackDown, further expanded the reach of our brands and enhanced the value of our content," said Nick Khan, WWE Chief Executive Officer. "Strategically, we entered into a historic agreement with Endeavor to create a one-of-a-kind company. With WWE and UFC we intend to form a global sports and entertainment business that has the potential to unlock vast growth opportunities for both businesses. We believe that bringing these two iconic and highly complementary brands together will allow us to increasingly capitalize on the rapidly expanding, global appetite for live sports events and premium entertainment content, with the goal being to maximize value for our shareholders."

Frank Riddick, WWE President & Chief Financial Officer, added "In the quarter, we exceeded the high end of our guidance. Adjusted OIBDA was $84 million on revenue of $298 million. Our financial performance was primarily driven by the contractual escalation of media rights fees for our flagship weekly programming and strong consumer demand for our live events. Our results in the quarter were also impacted by a shift in the timing of the staging of a large-scale international event."

First Quarter Highlights and WrestleMania

First Quarter 2023 Highlights

- Revenue was $297.6 million; Operating income was $53.1 million; and Adjusted OIBDA1 was $84.2 million

- Returned $8.9 million of capital to shareholders through dividend payments

- Each WWE premium live event (Royal Rumble and Elimination Chamber) set domestic unique viewership records with year-over-year increases of 52% and 54%, respectively

- Viewership for WWE's weekly flagship programs, Raw and SmackDown, both increased 7%, significantly outperforming overall cable and broadcast television, which declined 15% and 6%, respectively

- North American Live Events ticket sales revenue increased 52% over the prior year period, reflecting a 37% increase in average attendance

- In April, WWE announced an expansion of its partnership with Fanatics, with Fanatics assuming management of WWE's on-site event merchandise business as of May 1, 2023

WrestleMania Highlights (April 1-2, 2023)

- WrestleMania was held at SoFi Stadium in Los Angeles over two consecutive nights in front of a combined 161,892 fans and generating a gate of $21.6 million. WrestleMania was WWE's highest-grossing and most-attended event in company history

- WrestleMania was the most viewed WWE premium live event of all time. Global unique viewership increased 29% and domestic unique viewership increased 31% year-over-year

- WrestleMania sponsorship revenue exceeded $20 million, more than double the previous record set in the prior year

- WrestleMania was the most social WWE event of all-time, generating over 500 million views and 11 million hours of video consumed over the two days, a 42% increase over the prior year

- WrestleMania merchandise sales increased 20% versus the previous record set in the prior year

WWE-Endeavor Deal Highlights

WWE and Endeavor Transaction Highlights

- As previously disclosed, on April 3, 2023, WWEand Endeavor announced an agreement to combine WWE and UFC to form a new, publicly listed company. Upon close, Endeavor will hold a 51% controlling interest and existing WWE shareholders will hold a 49% interest in the new company

- The transaction values UFC at an enterprise value of $12.1 billion and WWE at an enterprise value of $9.3 billion. The transaction represents a contribution price of WWE of approximately $106 per share (before any post-closing dividend)

- Following the closing, the new public company, in which WWE shareholders will initially hold 100% of the economic interest, is expected to issue a post-closing dividend consisting of excess cash at WWE

- The transaction is expected to close in the second half of 2023. The transaction is subject to the satisfaction of customary closing conditions, including receipt of required regulatory approvals

2023 Business Outlook2

- The Company reaffirms its expectations for 2023, which target record revenue and an Adjusted OIBDA range of $395 to $410 million, which would be an all-time record

WWE's First-Quarter Consolidated Results

First-Quarter Consolidated Results

Revenue decreased 11%, or $35.8 million, to $297.6 million, primarily due to a shift in the timing of the staging of a large-scale international event, which occurred in the first quarter of 2022 but is expected to occur in the second quarter of 2023. This decrease was partially offset by an increase in revenue related to the contractual escalation of media rights fees for the Company's flagship weekly programming, Raw and SmackDown, and higher North American ticket sales.

Operating Income decreased 43%, or $39.3 million, to $53.1 million, reflecting the decrease in revenue and relatively flat operating expenses. Operating expenses primarily reflected a decrease in production costs related to the timing of the Company's premium live events essentially offset by the impact of certain costs related to the Company's strategic alternatives review and recently announced agreement with Endeavor. (See the "WWE and Endeavor Transaction" discussion for further details.) The Company's operating income margin decreased to 18% from 28%.

Adjusted OIBDA decreased 25%, or $27.5 million, to $84.2 million. The Company's Adjusted OIBDA margin decreased to 28% from 34%.

Net Income was $36.7 million, or $0.43 per diluted share, a decrease from $66.1 million, or $0.77 per diluted share, primarily reflecting the decrease in operating performance and an increase in the Company's effective tax rate.

Cash flows generated by operating activities were $12.6 million, a decrease from $93.8 million, primarily due to lower net income and higher working capital requirements.

Free Cash Flow3 was an outflow of $20.6 million, a decrease of $90.3 million from an inflow of $69.7 million, primarily due to the decline in cash flows generated by operating activities and higher capital expenditures. For the three months ended March 31, 2023, the Company incurred $29.6 million of capital expenditures related to its new headquarter facility. Excluding the capital expenditures related to the new headquarter facility, Free Cash Flow for the three months ended March 31, 2023 was $9.0 million.

Cash, cash equivalents and short-term investments were $465.3 million as of March 31, 2023. The Company currently estimates debt capacity under its revolving line of credit of $200 million.